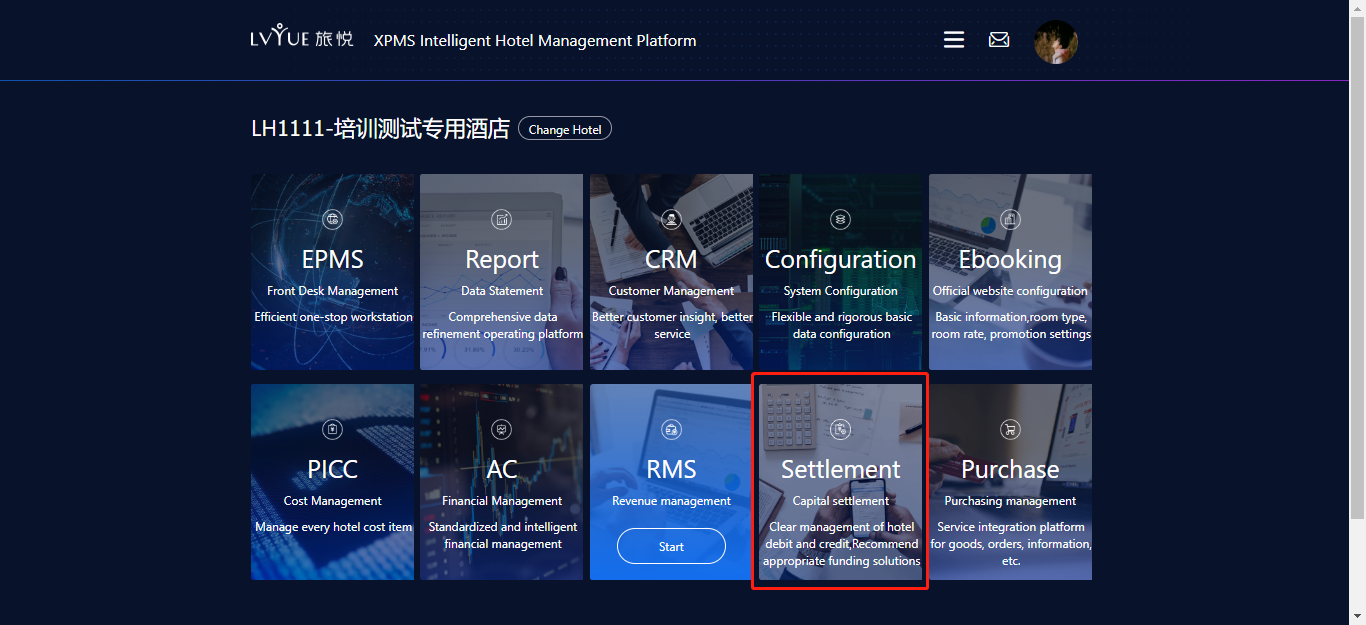

1. User and Access method

XPMS hotel management platform

User: financial department staff and hotel manager

2. XPMS capital settlement instruction

2.1. Asset account

Ø Asset account - Merchant Wallet

Hotels check all asset accounts and day to day account

Ø Asset account - invoicing management

Hotels check all the records of invoice

2.2. Bill center

Ø Bill center – hotel bill – cycle fee items

Monthly bill, including each cost items

Ø Bill center – hotel bill – one time bill

E.g. franchise fee, brand deposit

Ø Bill center – hotel bill – bill adjustment

Adjustment bill of accounts receivable and accounts payable

Ø Bill center – hotel bill – settlement

Monthly statement of account

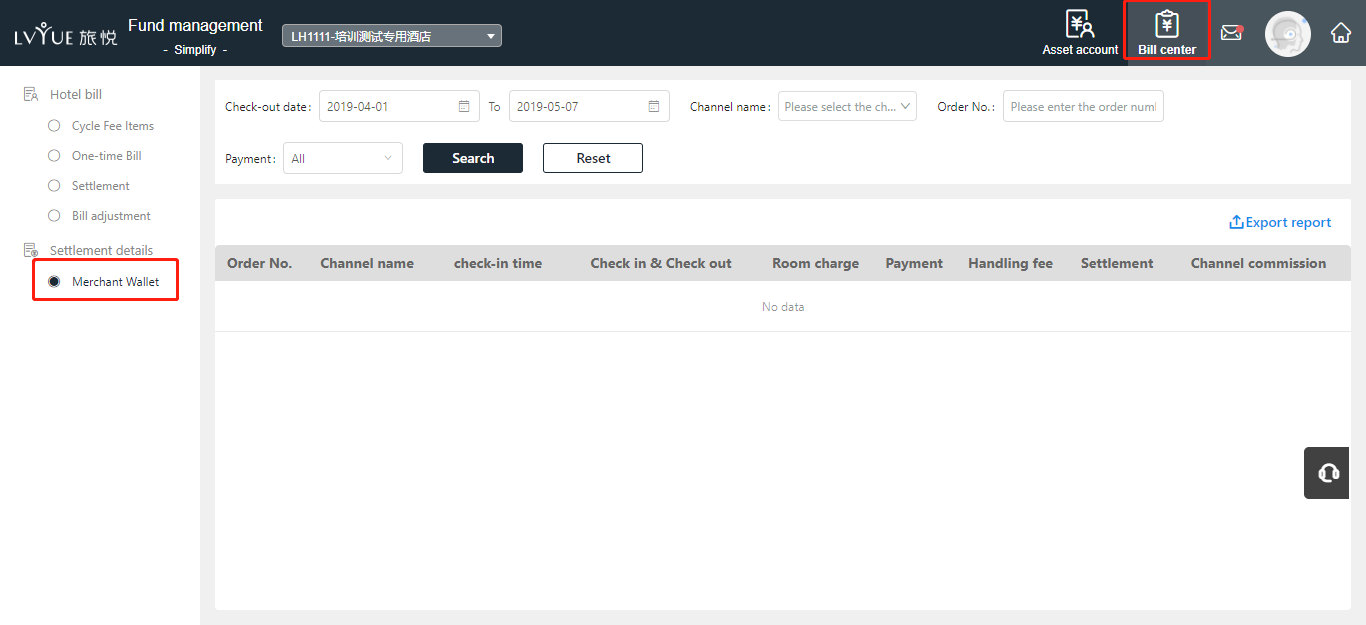

Ø Bill center – settlement details – merchant wallet

Hotel can check all the order detail refer to the statement of account. Total Bill settlement account within the payment day equal to statement of account.

3. Operating instruction

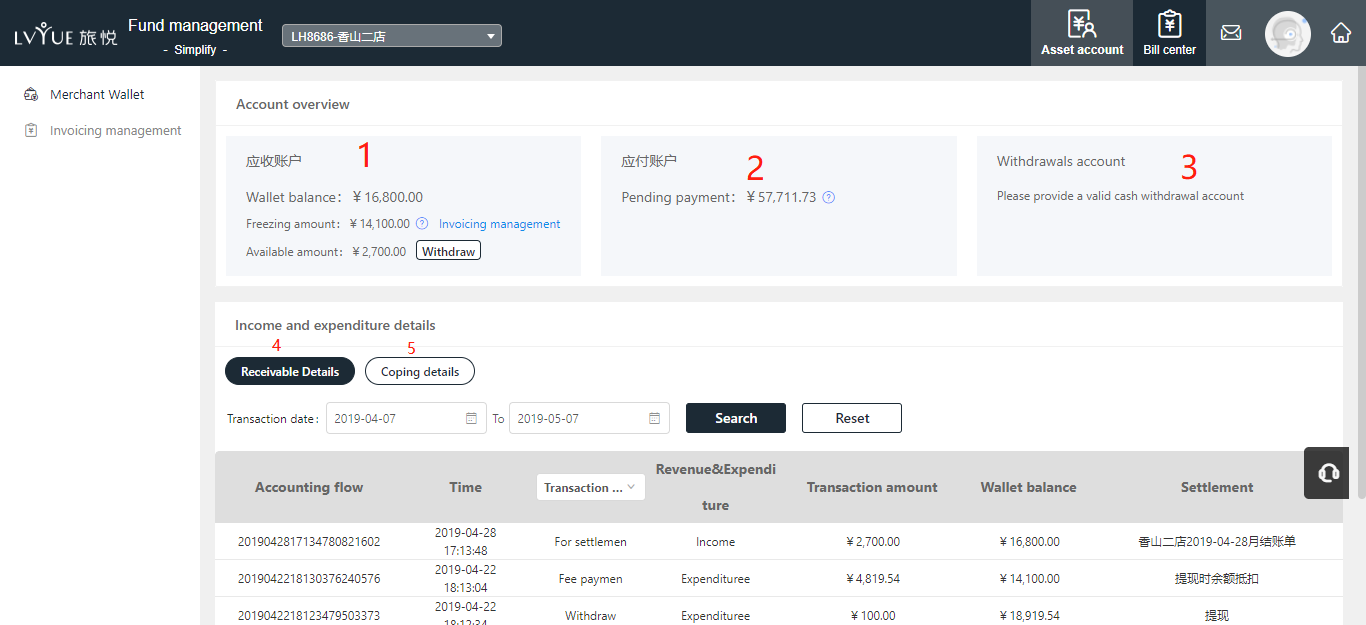

3.1. Asset account-Merchant Wallet

3.1.1 Description

Ø Asset account-Merchant Wallet:

Financial staffs check the overview account in this page

1. Hotel’s settlement account: enter the ledger. Wallet balance, Freezing amount, Available amount

2. Pending payment: hotel needs to pay residual payments.

3. Withdraw account information

4. Income and expenditure details of receivable account: detail of merchant wallet, settlement payment, withdraw, cost deductions

² The transaction type is the withdrawal accounting flow, corresponding to the withdrawal initiated by the hotel

² Transaction type is the settlement of the accounting flow, corresponding to the hotel has issued a statement

² The transaction type is the account flow of balance deduction, and the amount of accounts payable expense is written off, corresponding to a balance of accounts payable is written off

5. Payable account details: the accounting flow of the hotel's account payable, including bills of fees, offline bank transfer verification expense flow, balance verification expense flow, etc.

² The transaction type is the withdrawal accounting flow, corresponding to the withdrawal initiated by the hotel

² Transaction type is the settlement of the accounting flow, corresponding to the hotel has issued a statement

3.1.2 Operating instruction

1. Asset account-Merchant Wallet

Ø Hotel can check the bill detail according to time

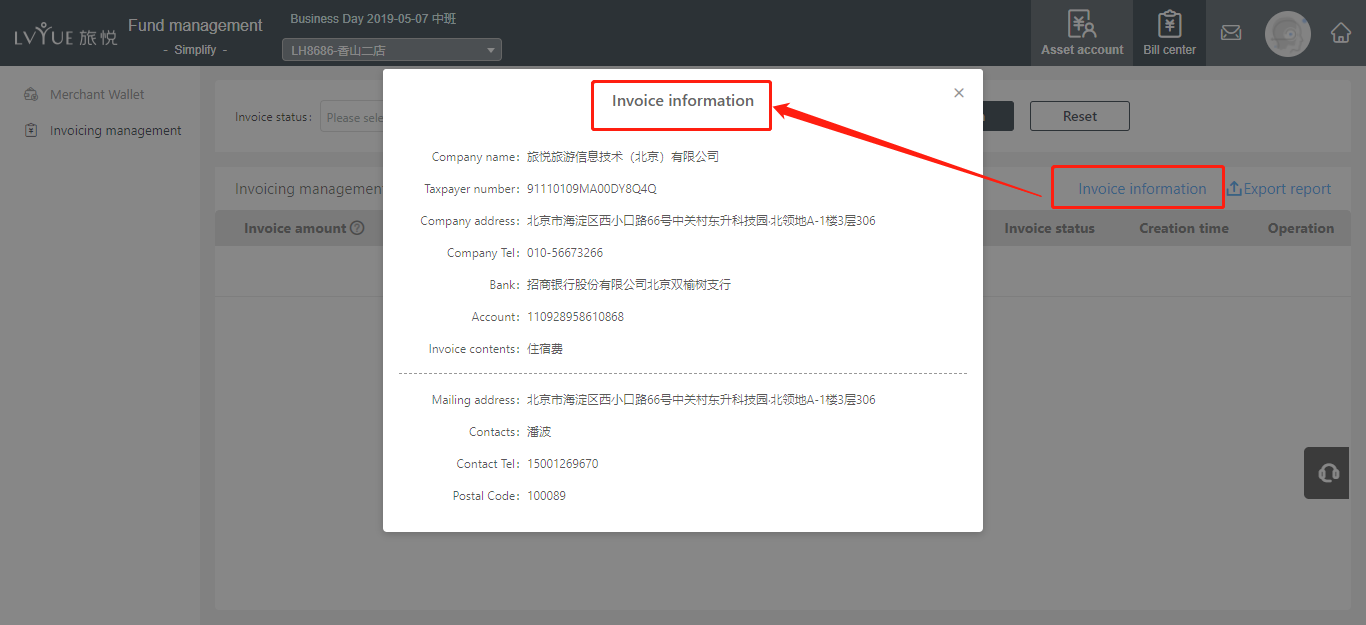

3.2. Asset account-invoicing managemen

3.2.1 Description

Hotel check invoicing history, including pending invoice and invoice has been done

3.2.2 Operating instruction

1. Asset account-invoicing management

Ø Status: pending invoice history, including invoices need to be provided by hotel to Lvyue.

2. Invoice management

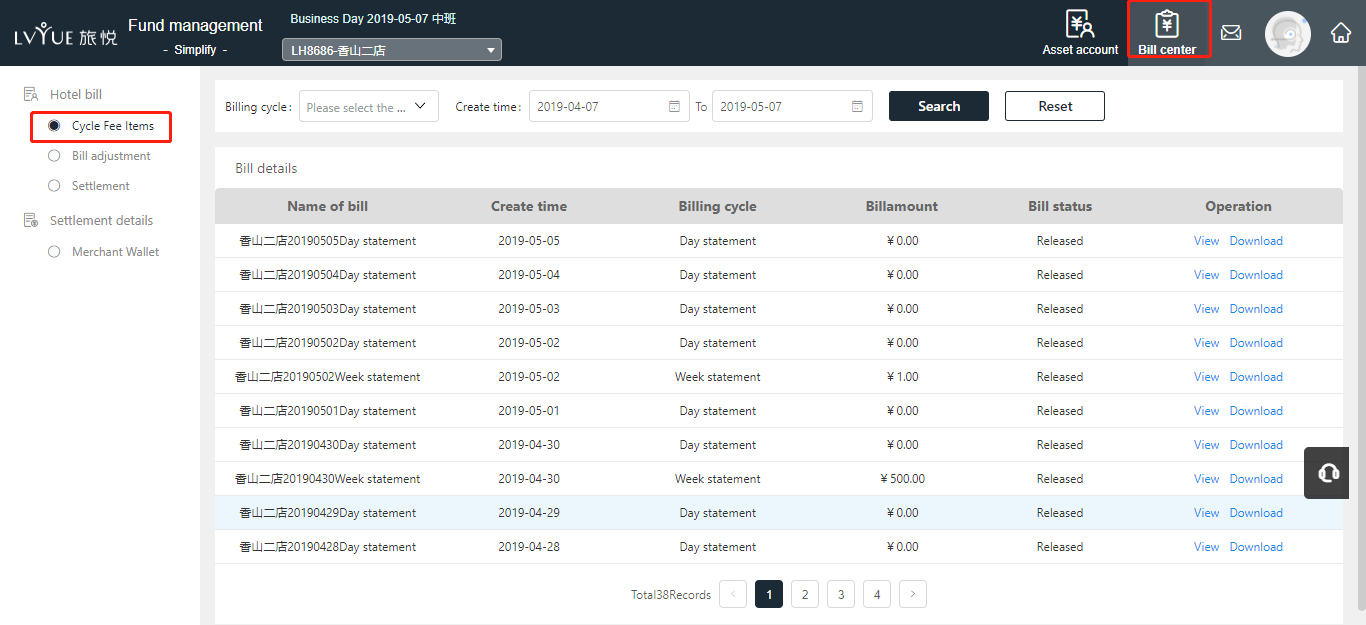

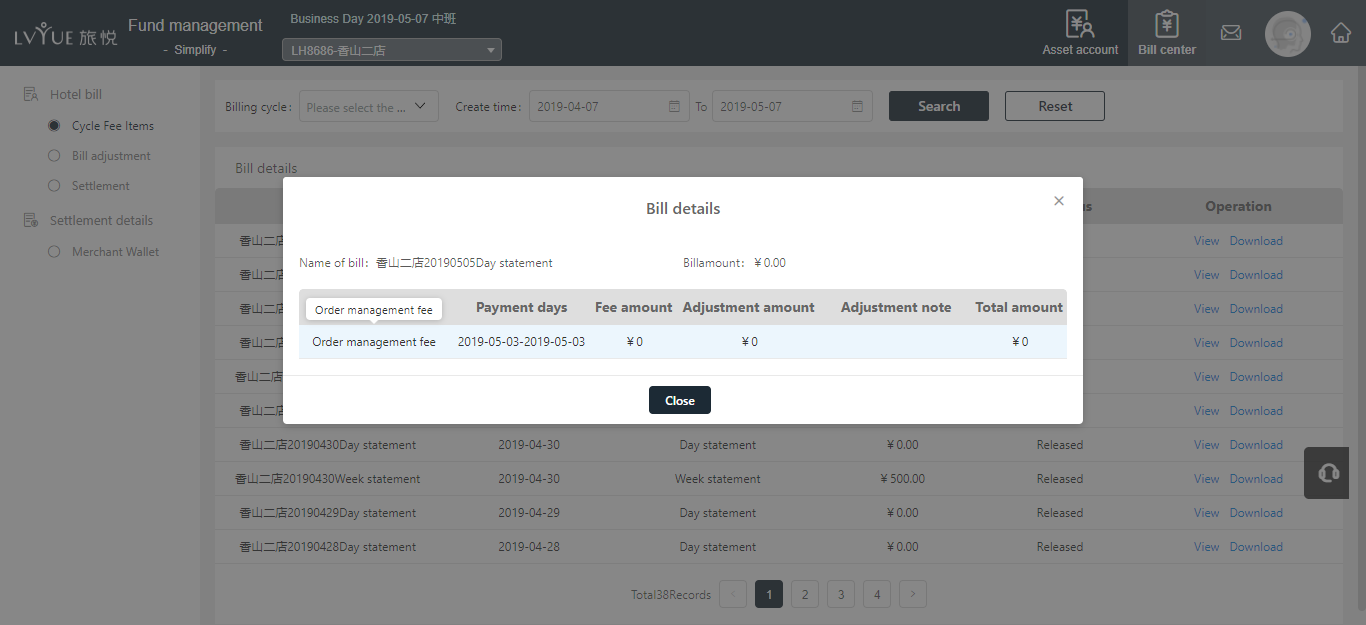

3.3. Bill center-Hotel bill-Cycle fee items

3.3.1 Description

The hotel can view the cycle fee items, the bill contains the billing amount of each fee, including management fee, manager fee, published cycle bill will affect the amount to be paid, record the hotel accounts payable flow.

3.3.2 Operating instruction

1. Bill center-Hotel bill-Cycle fee items

2. click “view” to check all bill amount, such like management fee, hotel manager fee.

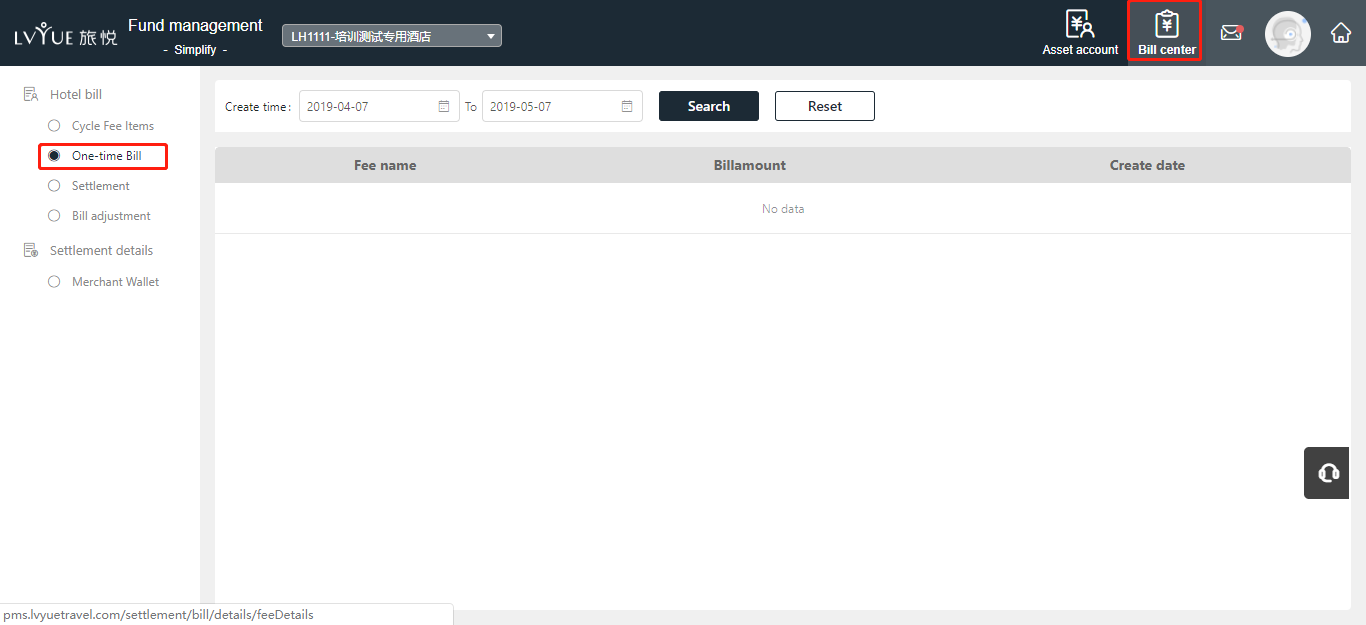

3.4. Bill centre-Hotel bill-一One-time Bill

3.4.1 Description

Hotel can check one time bill, like brand franchise fee, brand deposit.

It may influence payable account.

3.4.2 Operating instruction

1. Bill centre-Hotel bill-一One-time Bill

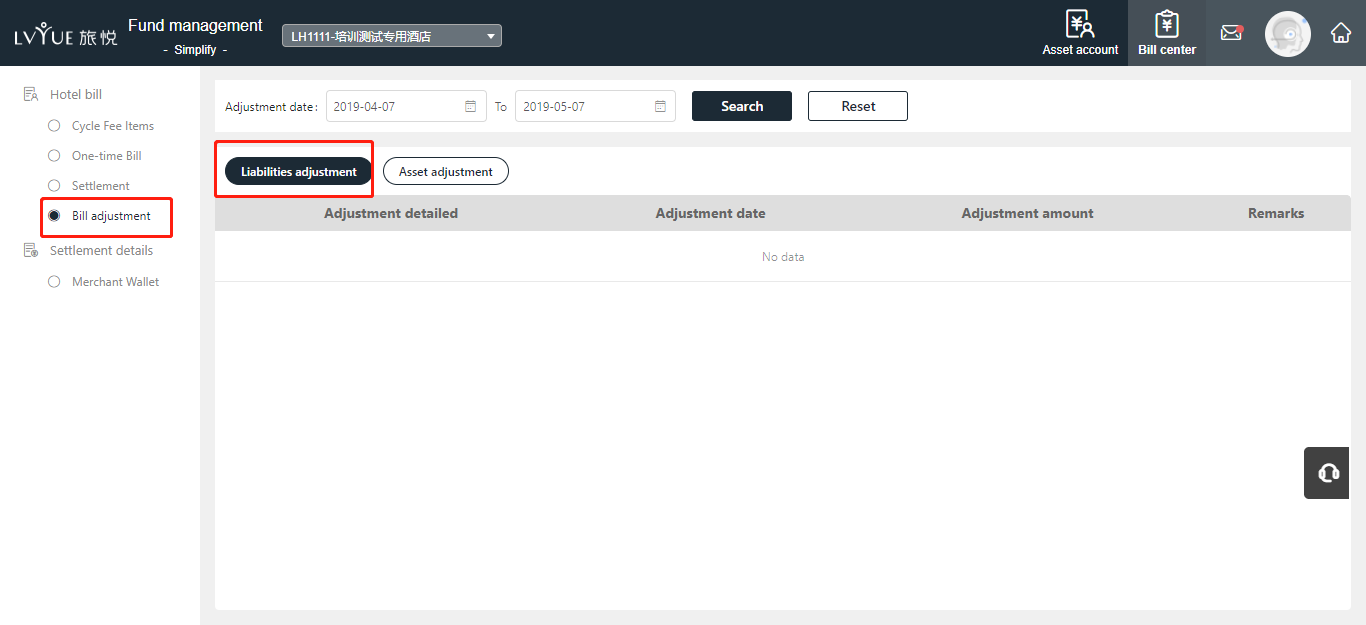

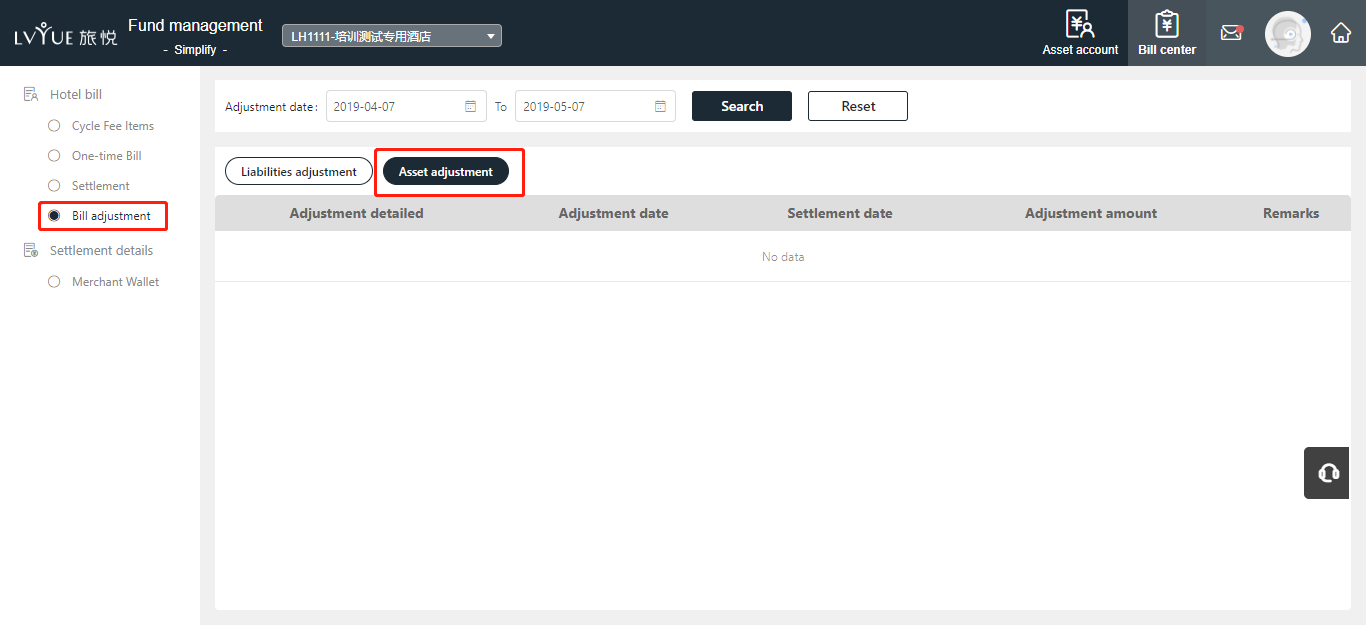

3.5. Bill centre –Hotel bill-Bill adjustment

3.5.1 Description

According to the agreement between Lvyue finance department and the property, lvyue finance will adjust the accounts of receivable and payable of the hotel, and the hotel can check the adjustment bill.

3.5.2 Operating instruction

1. Bill centre –Hotel bill-Bill adjustment, liabilities adjuestment

2. Bill centre –Hotel bill-Bill adjustment, asset adjustment

3.6. Settlement details-Merchant wallet

3.6.1 Description

The hotel can check the settlement order in merchant wallet. Settlement amount of total order details is equal to the settlement amount in the statement.

3.6.2 Operating instruction

3.7. 1. Settlement details-Merchant wallet

settlement amount = room fee – service charges